Canada January 2025 OAS Boost: Get ready for a significant increase in Old Age Security (OAS) payments starting January 2025! This article breaks down the projected boost, its impact on Canadian seniors, and what it means for the government’s budget. We’ll explore how this increase affects seniors’ finances, compares to other pension plans, and examines the long-term sustainability of the OAS program.

Let’s dive in and understand the details of this important change.

We’ll cover the percentage increase, the calculation methodology, and the factors influencing it. We’ll also look at the potential economic impact on seniors, including how the extra money might be spent and its effect on poverty rates. Finally, we’ll analyze the government’s budgetary implications and discuss the long-term outlook for the OAS program.

Projected OAS Increase in January 2025

The Old Age Security (OAS) benefit is set to receive a significant boost in January 2025. This increase, determined annually by the government, directly impacts the financial well-being of millions of Canadian seniors. Understanding the projected increase, its impact, and the long-term implications is crucial for both seniors and policymakers.

Projected OAS Benefit Increase

The anticipated percentage increase in the OAS benefit for January 2025 is determined by the rate of inflation as measured by the Consumer Price Index (CPI). While the exact percentage isn’t finalized until closer to the date, historical data suggests an increase aligning with the previous year’s inflation rate. For example, if the average inflation rate for 2024 is 3%, then the OAS benefit would likely increase by approximately 3% in January 2025.

This calculation is based on the government’s established methodology of indexing the OAS payments to inflation to maintain the purchasing power of the benefit.

So, you’re looking into the Canada January 2025 OAS boost? That’s great planning! While you’re sorting out your finances, why not check out this amazing spectacle happening concurrently: the lions drone show. It’s a fantastic way to celebrate and maybe even forget about budgeting for a bit! Then, armed with some awesome memories, you can get back to focusing on that OAS increase.

Factors Influencing the Projected Increase

Several factors contribute to the projected increase. The primary driver is inflation, as measured by the CPI. Government policy also plays a role; changes in the indexing methodology or decisions to provide additional top-ups could influence the final increase. For instance, a government decision to provide a one-time bonus to OAS recipients would add to the total amount received in January 2025 beyond the inflation-adjusted increase.

Projected OAS Payments for Different Income Levels

The following table provides a hypothetical example of projected OAS payments for different income levels in January 2025, assuming a 3% increase. Remember that actual amounts may vary based on the final inflation rate and individual circumstances.

| Income Level (Annual) | Current Monthly OAS (CAD) | Projected Monthly OAS Increase (3%) (CAD) | Projected Monthly OAS (CAD) |

|---|---|---|---|

| $20,000 | 600 | 18 | 618 |

| $30,000 | 600 | 18 | 618 |

| $40,000 | 600 | 18 | 618 |

| $50,000 | 500 | 15 | 515 |

Impact on Canadian Seniors

The OAS boost will have a considerable impact on Canadian seniors. Increased financial security, altered spending patterns, and potential decreases in senior poverty rates are all anticipated outcomes.

Economic Impact and Spending Habits

The additional funds from the OAS increase will provide many seniors with greater financial flexibility. This could lead to increased spending on essential goods and services, potentially boosting local economies. Some seniors might choose to invest the extra funds, while others may use it to reduce debt or improve their living conditions. For example, a senior might use the extra funds to pay for home repairs, prescription medications, or social activities.

Effects on Senior Poverty Rates, Canada january 2025 oas boost

The OAS increase is expected to contribute to a reduction in senior poverty rates. While not a complete solution, the added income can significantly improve the financial stability of many low-income seniors, helping them meet basic needs and reducing their reliance on other social support programs. This is particularly impactful for seniors living alone or those with limited other sources of income.

Utilizing Additional OAS Funds

- Paying for essential expenses (groceries, utilities, medication)

- Reducing debt

- Home maintenance and repairs

- Healthcare expenses

- Social activities and leisure

- Travel

- Supporting family members

- Investing for the future

Government Budgetary Implications: Canada January 2025 Oas Boost

The OAS increase will necessitate a larger government expenditure. Analyzing the cost implications, its relation to the overall budget, and potential impacts on other programs is vital for responsible fiscal management.

Cost of the OAS Increase

The exact cost of the OAS increase will depend on the final percentage increase and the number of OAS recipients. A conservative estimate, assuming a 3% increase and a stable number of recipients, would be in the billions of Canadian dollars annually. This represents a significant expenditure but is a relatively small percentage of the overall federal budget, demonstrating the government’s commitment to supporting seniors.

Impact on Other Government Programs

While the OAS increase represents a substantial commitment, its impact on other government programs will likely be minimal. The government generally prioritizes social programs, and the OAS increase is considered a core component of Canada’s social safety net. However, potential budget constraints in other areas might necessitate careful prioritization of spending across different government departments.

Consequences of Varying OAS Increases

A significantly larger increase would provide greater financial relief for seniors but would also increase the government’s budgetary burden. Conversely, a smaller increase would lessen the financial strain on the government but could negatively impact the living standards of low-income seniors and potentially increase senior poverty rates.

Comparison with Other Pension Plans

Comparing the OAS increase with adjustments in other Canadian pension plans, such as the Canada Pension Plan (CPP), provides context to its relative importance within the overall retirement income system.

Okay, so you’re looking at the Canada January 2025 OAS boost, right? That’s a pretty big deal for seniors. But while we’re talking about important Canadian news, check out this crazy story: a canadian water bomber hit by drone ! It makes you think about the unexpected ways technology impacts us, even while we’re focusing on important financial changes like the OAS increase.

So, back to that OAS boost – let’s hope the increased payments help offset some of life’s unexpected events.

Relative Importance of OAS Boost

The OAS increase is a significant component of retirement income for many Canadians, particularly those with lower CPP or other private pension contributions. While the CPP typically provides a larger benefit amount for higher earners, the OAS acts as a crucial safety net for lower-income seniors, ensuring a minimum level of income in retirement. The combined effect of both plans is what truly determines the overall retirement income security for most Canadian seniors.

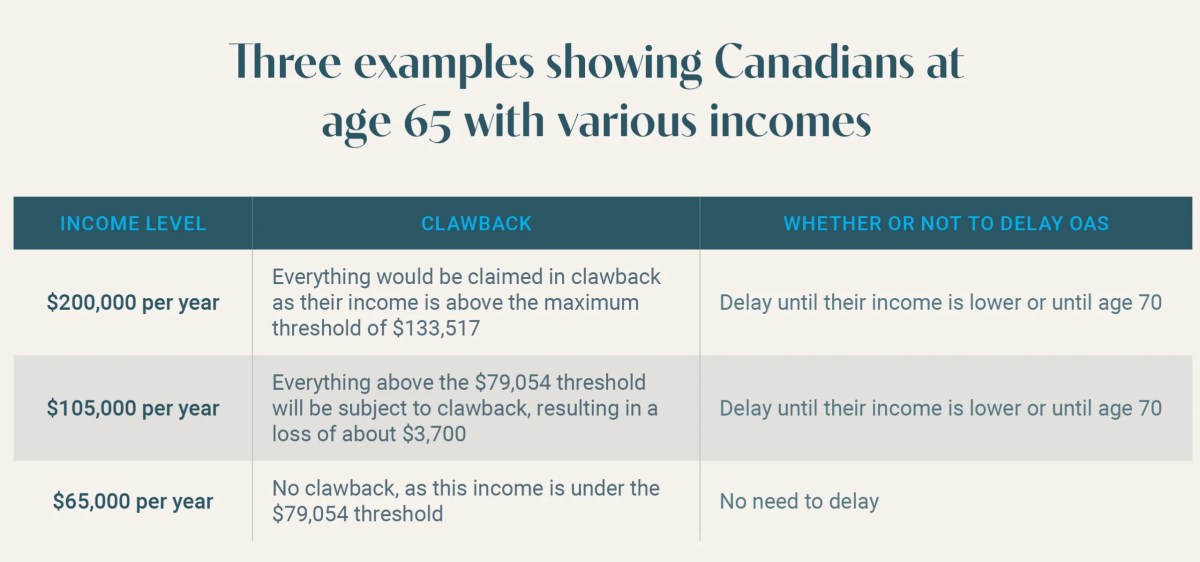

Benefit Structures and Eligibility Criteria

OAS and CPP have different benefit structures and eligibility criteria. OAS is a universal benefit available to all eligible Canadian seniors based on age and residency requirements. CPP, on the other hand, is a contributory plan where benefits are based on individual contributions made throughout their working lives. This means that higher earners generally receive higher CPP benefits, while OAS provides a more equitable baseline for all eligible seniors.

Combined Effect of OAS and Other Pension Plans

The following table illustrates a hypothetical example of the combined effect of OAS and CPP on retirement income for various income brackets, assuming a 3% OAS increase in January 2025. Actual amounts may vary based on individual contributions and eligibility.

| Income Bracket (Annual) | Projected Monthly OAS (CAD) | Projected Monthly CPP (CAD) | Total Monthly Retirement Income (CAD) |

|---|---|---|---|

| $20,000 | 618 | 500 | 1118 |

| $40,000 | 618 | 1000 | 1618 |

| $60,000 | 618 | 1500 | 2118 |

| $80,000 | 618 | 2000 | 2618 |

Long-Term Sustainability of OAS

The long-term financial sustainability of the OAS program is a crucial consideration given Canada’s aging population. Addressing this requires careful planning and potential policy adjustments.

Addressing Long-Term Viability

Several policy options exist to ensure the long-term viability of the OAS program. These include adjusting eligibility ages, gradually reducing benefits for higher-income earners, or exploring alternative funding mechanisms. A combination of strategies may be necessary to maintain the program’s solvency while ensuring adequate support for Canadian seniors.

Consequences of Failing to Address Sustainability

Failure to address the long-term sustainability of the OAS program could lead to significant challenges. Reduced benefits, increased taxes, or cuts to other social programs might become necessary to compensate for the growing financial burden. Maintaining a sustainable OAS program is crucial for maintaining Canada’s social safety net and ensuring the well-being of future generations of seniors.

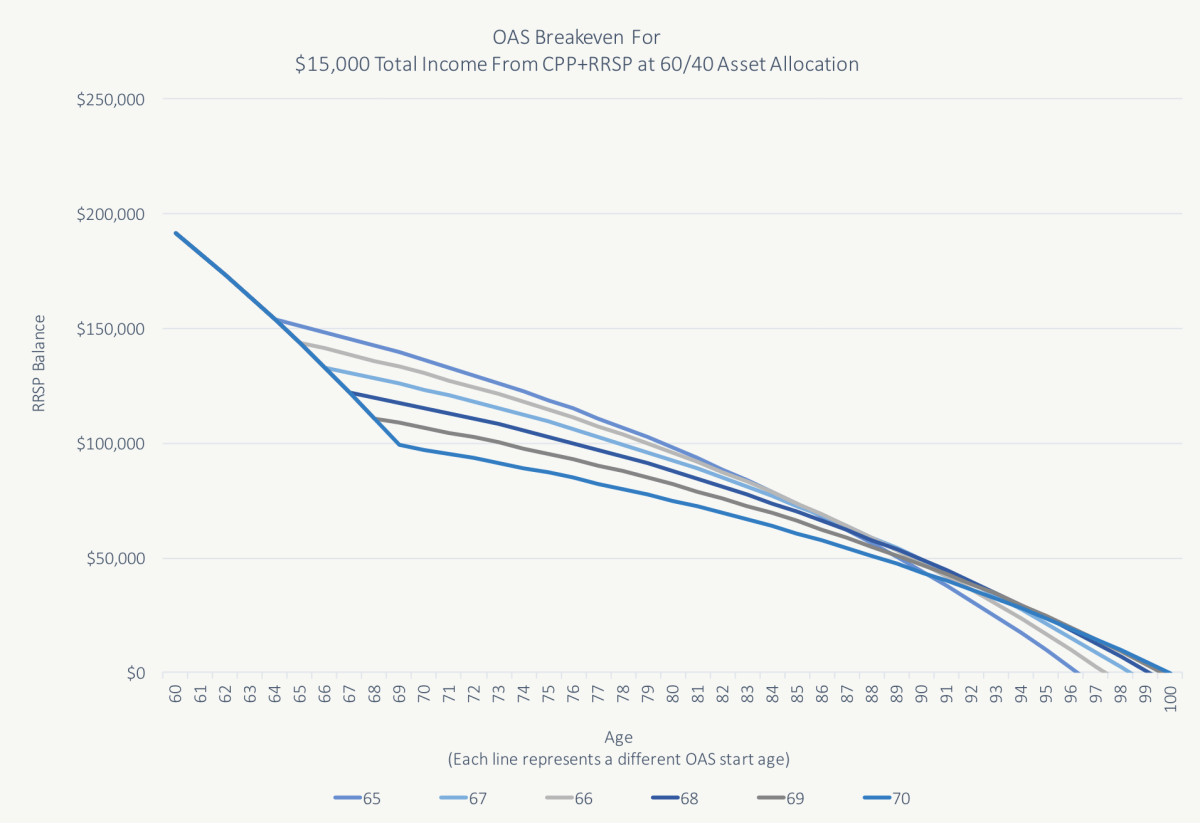

Visual Representation of OAS Boost

A line graph could effectively illustrate the projected increase in OAS payments over time. The x-axis would represent the year, while the y-axis would show the monthly OAS payment amount. Data points would represent the OAS payment for each year, with a clear highlight showing the January 2025 boost. The graph would use a clear and concise legend to explain the data presented.

A descriptive title, such as “Projected OAS Payments: 2020-2030,” would enhance readability.

A pie chart could visually represent the breakdown of OAS payments and their impact on senior’s living expenses. Each segment of the pie would represent a different expense category (housing, food, healthcare, etc.), with the size of the segment corresponding to the proportion of the OAS payment allocated to that category. A clear and concise caption would explain the proportions and highlight the impact of the OAS increase on different aspects of senior living.

For example, the caption might read: “Breakdown of OAS Payments and their Impact on Senior Living Expenses (Illustrative Example).” This would provide a clear visual understanding of how the increased OAS benefit can be used to manage various senior living expenses.

Final Review

The Canada January 2025 OAS boost represents a significant development for Canadian seniors and the country’s financial landscape. Understanding the projected increase, its impact, and the long-term implications is crucial for both seniors planning their retirement and policymakers ensuring the program’s future viability. While the increase offers immediate financial relief, consideration of the long-term sustainability of the OAS program remains paramount.

We hope this overview has provided clarity and valuable insights into this important topic.

Q&A

Will the OAS boost affect Guaranteed Income Supplement (GIS) payments?

Yes, the GIS is adjusted based on OAS payments, so an increase in OAS will likely lead to a change in GIS payments as well.

How is the OAS increase calculated each year?

The increase is typically tied to the Consumer Price Index (CPI), reflecting the rate of inflation. However, the government can adjust this based on policy decisions.

When will I receive the increased OAS payment?

So, you’re looking into the Canada January 2025 OAS boost? That’s smart planning! While you’re figuring out your finances, maybe check out this awesome spectacle happening down south: drone show detroit – a total visual treat! It’s a nice distraction while you crunch the numbers on that extra OAS money coming in next year.

Back to the OAS boost – remember to confirm the official details closer to January 2025.

The increased payment should be included in your January 2025 OAS payment.

What if I’m already receiving the maximum OAS payment?

You’ll still receive the percentage increase on your current maximum payment.